|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

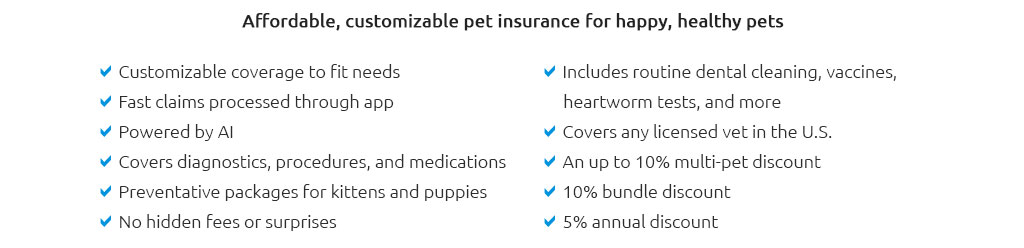

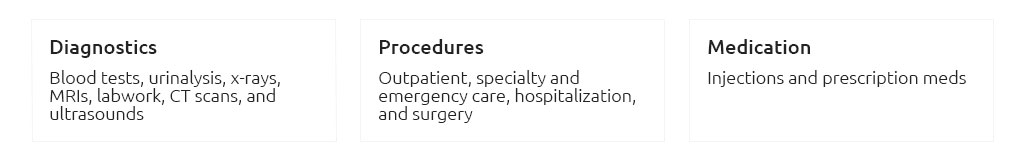

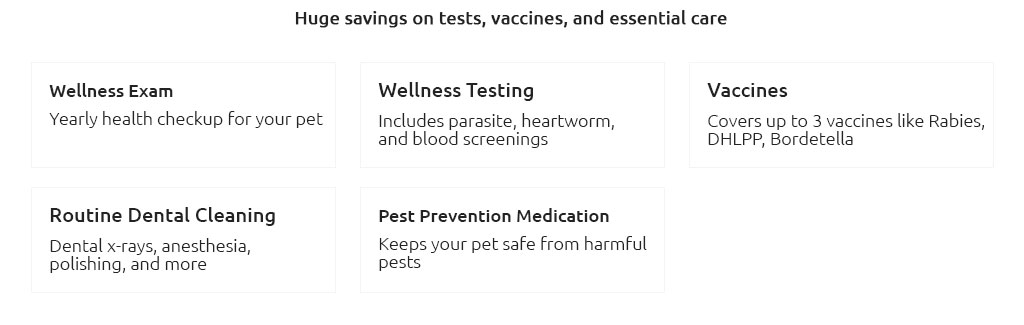

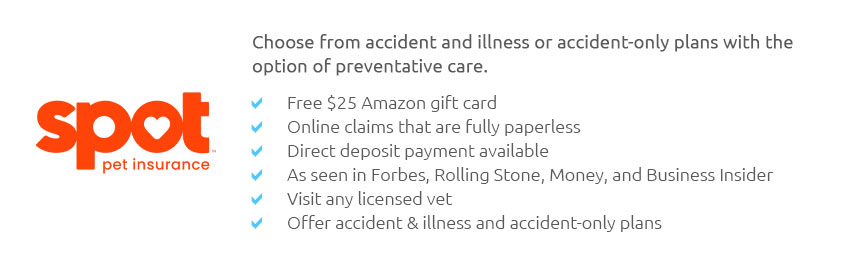

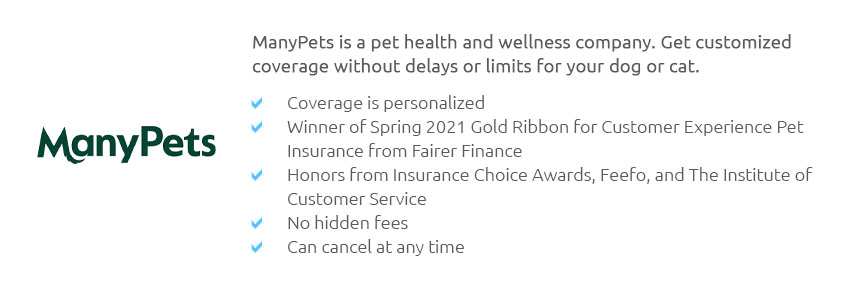

Top Health Insurance for Dogs: What You Need to KnowChoosing the right health insurance for your furry friend is an essential part of responsible pet ownership. With veterinary care costs rising, ensuring your dog has the best possible coverage can save you from unexpected expenses and provide peace of mind. However, the vast array of options available can make this task daunting. In this article, we'll explore the top health insurance options for dogs, the factors you should consider when selecting a plan, and why investing in pet insurance might just be one of the best decisions you make for your beloved companion. To begin with, it’s crucial to understand what pet health insurance typically covers. Most policies offer coverage for accidents and illnesses, including diagnostics, treatments, and medications. Some even provide wellness care options that cover routine exams, vaccinations, and preventative treatments. However, no two insurance policies are identical, and the key is finding one that aligns with your dog's specific needs. Among the top providers, Healthy Paws stands out for its comprehensive coverage and excellent customer service. They offer a plan that covers new accidents and illnesses, including hereditary and congenital conditions, with no payout limits. This is particularly advantageous for owners of breeds prone to certain genetic issues. On the other hand, Trupanion offers a unique approach with its no-payout-limit policy and direct vet payment option, which can ease the burden of upfront costs. Moreover, Nationwide provides an impressive range of plans, including one of the few that cover wellness care. This is ideal if you're looking for a more inclusive package that handles everything from dental cleanings to chronic conditions. In contrast, Embrace is known for its customizable plans and diminishing deductibles, which reward you for not making claims by reducing your annual deductible. When selecting a plan, there are several factors to consider beyond just the monthly premium. First, evaluate the coverage details and limitations; not all plans cover hereditary conditions or alternative therapies, so it’s vital to read the fine print. Secondly, consider the reimbursement model. While some companies reimburse a percentage of the vet bill, others use a benefit schedule. Lastly, take note of any waiting periods, as some policies have extended times before coverage kicks in for certain conditions. So, why should you invest in dog health insurance? In many ways, it's a financial safety net that allows you to make decisions based on what's best for your dog rather than what's best for your wallet. Whether it’s a sudden illness or a long-term condition, having insurance means you can focus on your pet’s recovery rather than financial stress. Frequently Asked Questions

https://www.lemonade.com/pet

Here are a few important things to note about your pet health insurance plan. https://www.petsbest.com/

Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and ... https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ...

|